Timely invoice collection is the lifeline of any business. It ensures a steady cash flow, supports operational stability, and fosters sustainable growth. Yet, businesses of all sizes face significant challenges when clients delay payments or fail to settle invoices altogether.

Unpaid invoices can disrupt cash flow, delay critical projects, and strain relationships with clients. The frustration of chasing overdue payments not only wastes time but also diverts focus from core business activities. These challenges underline the need for proactive strategies to recover unpaid invoices effectively.

In this blog, we’ll explore proven strategies for collecting overdue payments, legal insights to navigate tricky situations, and real-world examples of how businesses have tackled unpaid invoices.

Stay with us as we dive deep into solutions that ensure your business gets paid on time while maintaining strong client relationships.

Why Are Unpaid Invoices a Problem for Businesses?

Unpaid invoices can create a domino effect of challenges for businesses, impacting financial stability, daily operations, and client relationships. Here’s how delayed payments disrupt businesses:

1. Impact on Cash Flow and Financial Stability

Cash flow is the backbone of any business. When invoices remain unpaid, businesses face immediate financial pressure.

- Operational Costs: Without timely payments, companies struggle to cover essential expenses like rent, utilities, and employee salaries.

- Growth Limitations: A lack of liquid cash delays investments in new opportunities, such as hiring, marketing campaigns, or expanding to new markets.

Example: A mid-sized tech company delayed launching a new product line by six months due to $100,000 in unpaid invoices from a major client.

2. Strain on Business Operations

Unpaid invoices directly affect daily operations, often forcing businesses to make difficult decisions.

- Salary Delays: Employees depend on their wages, and payment delays can harm morale and productivity.

- Paused Projects: Inability to procure resources or pay vendors on time halts progress on critical initiatives, damaging client delivery timelines.

Pro Tip: Implementing automated reminders and diverse payment options can help reduce late payments and operational disruptions.

3. Erosion of Trust and Relationships with Clients

Chasing overdue payments puts a strain on professional relationships.

- Repeated Follow-Ups: Frequent reminders, no matter how polite, can frustrate clients and lead to a breakdown in trust.

- Reputation Risks: Other clients or vendors might perceive a business struggling with overdue invoices as unreliable.

Key Insight: Maintaining professionalism during collection efforts is essential to preserving goodwill while ensuring payments are recovered.

Unpaid invoices are more than a financial inconvenience—they jeopardize the very stability of a business. By understanding these impacts, companies can prioritize proactive measures to address overdue payments before they escalate into bigger issues.

Common Causes of Unpaid Invoices

Unpaid invoices are not always the result of intentional delays by clients. Often, they stem from avoidable issues within the invoicing process. Understanding these common causes can help businesses take proactive measures to reduce payment delays.

1. Miscommunication Regarding Terms and Conditions

A lack of clarity about payment terms can lead to confusion and delays.

- Examples of Miscommunication:

- Unclear deadlines for payments.

- Ambiguity about late fees or penalties.

- The Result: Clients might assume extended payment windows or misunderstand their obligations, leading to overdue invoices.

Solution: Clearly outline payment terms in contracts and invoices, and communicate them during initial discussions.

2. Errors in Invoicing

Inaccurate or incomplete invoices can create disputes and delays.

- Common Mistakes:

- Incorrect amounts or calculations.

- Missing client details, such as company names or reference numbers.

- Listing charges not agreed upon, like additional fees or taxes.

- The Result: Clients may hold off payments until corrections are made, prolonging the collection process.

Pro Tip: Double-check invoices for accuracy before sending them and use automated invoicing systems to minimize human error.

3. Limited or Inconvenient Payment Options

Restrictive payment methods can discourage timely payments.

- Examples of Inconvenience:

- Only accepting physical checks or bank transfers.

- Lack of digital payment methods like online gateways or credit card options.

- The Result: Clients may delay payments until they can access the required method, especially in emergencies.

Solution: Offer multiple payment options to make the process seamless for clients.

4. Lack of Follow-Up or Reminders

Sometimes, clients simply forget to pay.

- The Problem: Without consistent follow-ups, invoices can slip through the cracks, especially for clients managing multiple accounts.

- The Result: Delayed payments become a recurring issue due to a lack of gentle reminders.

Pro Tip: Implement automated reminders and maintain a professional tone to encourage prompt payments without damaging relationships.

By addressing these common causes, businesses can significantly reduce the frequency of unpaid invoices. The key lies in proactive communication, error-free invoicing, and client-friendly payment systems.

Effective Strategies for Recovering Unpaid Invoices

Recovering unpaid invoices requires a mix of proactive measures, consistent follow-ups, and strategic escalation. Here are actionable strategies to ensure timely payments while maintaining positive client relationships.

1. Proactive Approaches

The best way to recover unpaid invoices is to prevent them from happening in the first place. Establish clear processes and communication from the start.

Clear Communication of Payment Terms During Contract Signing

- Outline payment deadlines, late fees, and penalties explicitly in contracts.

- Provide clients with a detailed explanation of payment expectations to avoid misunderstandings.

Pro Tip: Include payment terms in all client-facing documents, such as proposals and invoices, for reinforcement.

Ensuring Accurate and Detailed Invoices

Use invoicing tools to minimize human errors. Ensure invoices include all necessary details, such as client names, reference numbers, and a breakdown of charges.

Example: A graphic design firm reduced invoice disputes by 40% after adding itemized charges and clear descriptions to their invoices.

Offering Diverse and Convenient Payment Methods

- Accept digital payment gateways, credit cards, and bank transfers.

- Ensure clients can pay through their preferred methods to reduce delays caused by inconvenience.

2. Follow-Up Techniques

Consistent and professional follow-ups are crucial for recovering overdue payments.

Automated Reminder Systems

- Set up email reminders for upcoming, due, and overdue invoices.

- Tailor reminders to maintain a polite yet firm tone.

Tip: Use invoicing software that automates reminders based on due dates.

Personal Follow-Ups via Email or Phone Calls

If automated reminders don’t work, follow up personally. Call clients to confirm they’ve received the invoice and address any issues delaying payment.

Example: A personal phone call resolved a delayed $25,000 payment for a construction company after the client cited a misunderstanding about due dates.

Leveraging Customer Relationship Management (CRM) Tools

- Track client communication and payment history using a CRM system.

- Use this data to create personalized follow-up messages, improving response rates.

3. Negotiating Payment Plans

For clients facing financial difficulties, offering payment plans can facilitate recovery while preserving the relationship.

When to Offer Installment Payments

- Offer this option when clients express genuine difficulty in paying the full amount.

- Use contracts to clearly define installment terms and deadlines.

Structuring a Plan That Benefits Both Parties

- Balance flexibility with accountability. For example, split payments into manageable chunks while maintaining a strict schedule.

Pro Tip: Add incentives like waiving late fees for clients who agree to and follow through with a payment plan.

4. When to Escalate

If all attempts fail, knowing when to escalate the matter is critical to recovering payments without unnecessary losses.

Identifying the Right Time to Involve Legal or Third-Party Collection Agencies

- Escalate when invoices are overdue by more than 90 days, and the client is unresponsive to follow-ups.

- Assess the cost-benefit of legal action or hiring a collection agency based on the amount owed.

Key Insight: Many businesses use third-party agencies for amounts exceeding $5,000 to avoid the high costs of pursuing smaller invoices legally.

By combining these proactive and reactive strategies, businesses can recover unpaid invoices more effectively while maintaining professional relationships and avoiding unnecessary escalation.

Legal Options for Unpaid Invoice Recovery

When all other methods fail, legal options can provide a structured path to recovering unpaid invoices. However, businesses must approach these measures strategically, understanding their rights, the processes involved, and the associated risks.

1. Understanding Your Legal Rights

Before taking legal action, businesses need to be aware of the laws governing invoice recovery in their jurisdiction.

Overview of Laws Governing Unpaid Invoices

- Most jurisdictions treat unpaid invoices as breaches of contract, giving businesses the right to seek recovery.

- Payment terms outlined in contracts or invoices serve as the foundation for legal claims.

Tip: Familiarize yourself with any specific regulations about late payment penalties or interest rates applicable in your region.

When to Issue a Formal Demand Letter

A formal demand letter is often the first legal step in recovering unpaid invoices.

This letter should outline:

- The total amount owed.

- The due date of the invoice.

- Any applicable penalties or interest.

- A clear deadline for payment before further action is taken.

Example: A demand letter resolved a $15,000 overdue invoice for a consultancy firm when the client realized the seriousness of the situation.

2. Taking Legal Action

If a demand letter does not produce results, businesses may escalate to formal legal proceedings.

Filing Small Claims or Civil Suits

- Small Claims Court: Best for lower-value invoices, as the process is quicker and less expensive.

- Civil Suits: Suitable for high-value invoices but involves more time and legal fees.

Pro Tip: Ensure all documentation (contracts, emails, and invoices) is well-organized to strengthen your case.

Engaging with Arbitration or Mediation

Arbitration: A neutral arbitrator makes a legally binding decision on the dispute.

Mediation: A mediator facilitates negotiations to help both parties reach an agreement.

These methods are often faster and less contentious than going to court.

Insight: Many businesses prefer mediation to preserve client relationships while resolving disputes.

3. Risks and Costs

While legal action can recover unpaid invoices, it is not without challenges.

Financial Costs

- Filing fees, attorney costs, and other legal expenses can add up.

- For small invoices, the cost of legal action may outweigh the benefits.

Relational Costs

- Taking a client to court can permanently damage the relationship, even if you win the case.

- Future collaborations with the client may no longer be possible.

Key Insight: Legal action should be a last resort, pursued only after other recovery methods have been exhausted.

By understanding the legal framework, preparing documentation, and carefully weighing the costs and benefits, businesses can use legal options effectively to recover unpaid invoices while minimizing financial and relational risks.

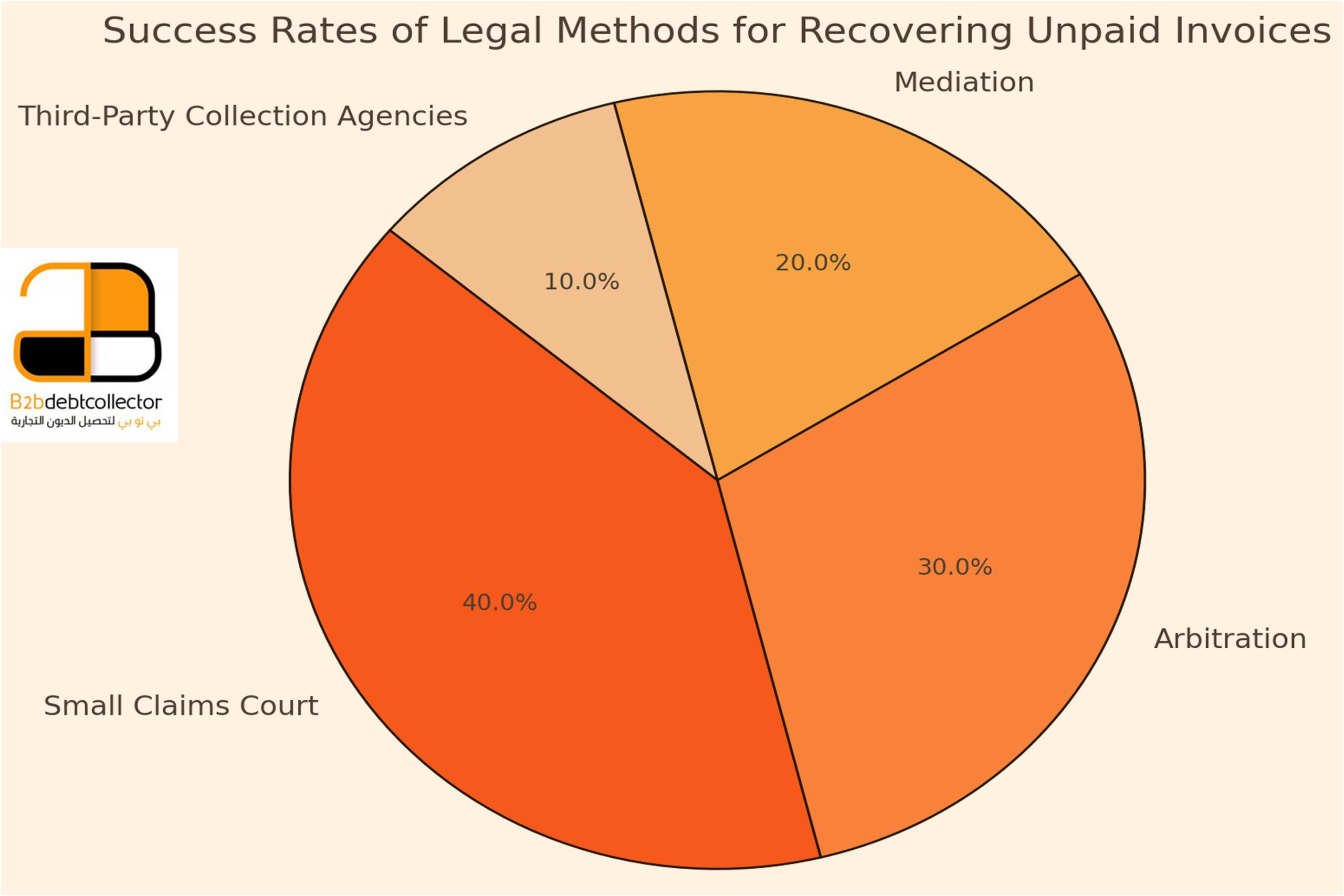

This pie chart illustrates the success rates of the most common legal methods for recovering unpaid invoices:

- Small Claims Court: A cost-effective method for small to medium-sized claims, but it may take longer depending on the jurisdiction.

- Arbitration: A quicker and less formal option than going to court, with a neutral third-party arbitrator making the final decision.

- Mediation: Involves a mediator to help the parties reach an agreement, maintaining professional relationships.

- Third-Party Collection Agencies: Effective for larger sums, these agencies handle collections but take a percentage of the recovery.

Choosing the Right Legal Method for Your Situation

When considering legal action for recovering unpaid invoices, understanding the success rate and associated risks of each option is crucial. While some methods, like small claims court, are accessible and cost-effective, others, like third-party collections, may offer a higher chance of recovery for larger debts. Weigh your options carefully before proceeding.

Key Insight: Legal action should be a last resort, pursued only after other recovery methods have been exhausted. Ensure that your documentation is thorough to maximize your chances of success.

Preventing Unpaid Invoices in the Future

Prevention is better than recovery. By establishing clear policies, leveraging technology, and maintaining professional communication, businesses can significantly reduce the risk of unpaid invoices. Here are actionable steps to ensure smoother payment processes.

1. Implementing Stricter Credit Policies for New Clients

Not all clients are equal when it comes to payment reliability. Implementing robust credit policies can help identify potential risks early.

Assess Client Creditworthiness

- Conduct credit checks before extending payment terms to new clients.

- Use references or financial reports to evaluate a client’s payment history.

Set Clear Limits

- Offer limited credit to new clients until they establish a reliable payment history.

- Require deposits or partial upfront payments for large projects.

Example: A marketing agency reduced overdue payments by 30% after requiring new clients to pay 50% upfront for campaigns.

2. Using Contracts That Clearly Outline Payment Terms and Penalties

A well-drafted contract is a business’s first line of defense against payment disputes.

Include Specific Payment Terms

- Clearly state due dates, acceptable payment methods, and late payment penalties.

- Use precise language to avoid ambiguity.

Pro Tip: Add a clause for early payment discounts to incentivize timely payments.

Detail Penalties for Late Payments

- Outline the interest rate or fixed fee for overdue invoices.

- Specify steps the business will take if payments remain unpaid, such as escalating to legal action.

Insight: Contracts serve as a legal foundation for recovering payments if disputes arise.

3. Leveraging Technology for Automated Invoicing and Payment Tracking

Modern tools simplify invoicing, minimize errors, and provide real-time tracking of payments.

Automate Invoice Generation

- Use invoicing software to create professional, error-free invoices.

- Include all necessary details like due dates, client information, and payment options.

Set Up Automated Reminders

- Schedule reminders for upcoming, due, and overdue payments to ensure clients don’t forget.

- Maintain a professional tone in all communications.

Track Payments in Real-Time

- Monitor payment statuses and generate reports to identify patterns of late payments.

- Use insights to improve payment policies or follow-up strategies.

Example: A consulting firm reduced payment delays by 40% after integrating a CRM tool that tracked client invoices and sent automated reminders.

By adopting these preventive measures, businesses can streamline their payment processes, build trust with clients, and minimize the stress and financial risks associated with unpaid invoices. Prevention saves time, preserves relationships, and keeps cash flow steady.

Preventing Unpaid Invoices in the Future

Prevention is better than recovery. By establishing clear policies, leveraging technology, and maintaining professional communication, businesses can significantly reduce the risk of unpaid invoices. Here are actionable steps to ensure smoother payment processes.

1. Implementing Stricter Credit Policies for New Clients

Not all clients are equal when it comes to payment reliability. Implementing robust credit policies can help identify potential risks early.

Assess Client Creditworthiness

- Conduct credit checks before extending payment terms to new clients.

- Use references or financial reports to evaluate a client’s payment history.

Set Clear Limits

- Offer limited credit to new clients until they establish a reliable payment history.

- Require deposits or partial upfront payments for large projects.

Example: A marketing agency reduced overdue payments by 30% after requiring new clients to pay 50% upfront for campaigns.

2. Using Contracts That Clearly Outline Payment Terms and Penalties

A well-drafted contract is a business’s first line of defense against payment disputes.

Include Specific Payment Terms

- Clearly state due dates, acceptable payment methods, and late payment penalties.

- Use precise language to avoid ambiguity.

Pro Tip: Add a clause for early payment discounts to incentivize timely payments.

Detail Penalties for Late Payments

- Outline the interest rate or fixed fee for overdue invoices.

- Specify steps the business will take if payments remain unpaid, such as escalating to legal action.

Insight: Contracts serve as a legal foundation for recovering payments if disputes arise.

3. Leveraging Technology for Automated Invoicing and Payment Tracking

Modern tools simplify invoicing, minimize errors, and provide real-time tracking of payments.

Automate Invoice Generation

- Use invoicing software to create professional, error-free invoices.

- Include all necessary details like due dates, client information, and payment options.

Set Up Automated Reminders

- Schedule reminders for upcoming, due, and overdue payments to ensure clients don’t forget.

- Maintain a professional tone in all communications.

Track Payments in Real-Time

- Monitor payment statuses and generate reports to identify patterns of late payments.

- Use insights to improve payment policies or follow-up strategies.

Example: A consulting firm reduced payment delays by 40% after integrating a CRM tool that tracked client invoices and sent automated reminders.

By adopting these preventive measures, businesses can streamline their payment processes, build trust with clients, and minimize the stress and financial risks associated with unpaid invoices. Prevention saves time, preserves relationships, and keeps cash flow steady.

How a Medium-Sized Company Used Legal Arbitration to Recover a Large Unpaid Invoice

Background:

A medium-sized marketing agency completed a $50,000 branding project for a long-term client. Despite the contract clearly stating payment terms of 30 days post-completion, the client delayed payment for over 90 days, citing internal financial constraints.

The Challenge:

The agency faced a dilemma:

- Pursuing Legal Action: Risked damaging a valued long-term client relationship.

- Avoiding Confrontation: Could result in financial strain and set a precedent for accepting late payments.

The company needed a solution that balanced recovery efforts with relationship management.

The Solution: Opting for Legal Arbitration

The marketing agency chose arbitration as a middle ground. Arbitration allowed them to escalate the issue without the formalities and public exposure of a court case.

Steps Taken:

- Engaging a Neutral Arbitrator: Both parties agreed on an arbitrator experienced in handling commercial disputes.

- Presenting Documentation: The agency provided clear evidence, including the signed contract, detailed invoices, and email communications with the client.

- Finding a Resolution: The arbitrator determined that the client’s financial constraints were valid but temporary. A resolution was reached: The client agreed to pay the full amount in two installments within 60 days, with no additional late fees.

The Outcome:

The agency recovered the full $50,000 within the agreed timeline. The client appreciated the professionalism and fairness of the arbitration process, leading to a stronger, renewed partnership. Both parties avoided prolonged legal battles, saving time and costs.

Key Takeaways:

- Choose Arbitration for Sensitive Situations: Arbitration provides a less confrontational and cost-effective way to resolve disputes while maintaining relationships.

- Maintain Clear Documentation: Detailed contracts and records are critical to presenting a strong case in any dispute resolution process.

- Preserve Relationships Through Professionalism: Balancing firmness with empathy can turn disputes into opportunities to build trust.

FAQs About Recovering Unpaid Invoices

1. What is the fastest way to recover an unpaid invoice?

The fastest way is to take a proactive approach:

- Send Automated Reminders: Use invoicing software to send polite reminders before and after the due date.

- Contact the Client Directly: A personal phone call or email can resolve misunderstandings quickly.

- Offer Flexible Payment Options: If the client is facing financial difficulties, consider offering an installment plan to facilitate payment.

Pro Tip: Clearly outline payment terms upfront to avoid delays in the first place.

2. How can I follow up without harming client relationships?

Maintaining a balance between professionalism and firmness is key:

- Start Polite: Send a friendly reminder when the invoice is a few days overdue.

- Be Firm but Respectful: If payment is still delayed, send a more formal follow-up outlining the consequences of non-payment.

- Seek to Understand: Ask if there are issues causing the delay, and offer solutions if possible, like extending the deadline or offering payment flexibility.

Key Insight: Always maintain a professional tone and avoid accusatory language to preserve goodwill.

3. Are there tools to automate invoice recovery processes?

Yes, many tools are available to streamline the recovery process:

- Invoicing Software: Tools like QuickBooks, Xero, and FreshBooks automate invoice generation and reminders.

- Customer Relationship Management (CRM) Systems: CRMs like HubSpot or Zoho help track payment histories and client communications.

- Payment Gateways: Platforms like Stripe and PayPal simplify the payment process, reducing delays caused by limited options.

Tip: Choose a tool that integrates with your accounting system for seamless management of invoices.

4. When should I seek legal help for unpaid invoices?

Legal action should be a last resort, pursued when:

- The invoice is more than 90 days overdue, and the client is unresponsive to follow-ups.

- The amount owed is significant enough to justify the legal costs.

- Alternative methods, like reminders and mediation, have failed.

Steps to Take Before Legal Action:

- Issue a formal demand letter to the client.

- Review the contract and documentation to ensure compliance with legal requirements.

- Consult a lawyer to understand your options, such as small claims court, arbitration, or hiring a collection agency.

Insight: Always weigh the financial and relational costs of legal action before proceeding.

Conclusion

Unpaid invoices are more than just a financial inconvenience—they can disrupt cash flow, strain business operations, and jeopardize client relationships. Addressing these issues proactively is essential to maintaining stability and fostering growth.

By implementing the strategies discussed in this blog, such as clear communication, accurate invoicing, and leveraging technology, businesses can reduce the occurrence of unpaid invoices. For those invoices that remain overdue, effective follow-ups, payment plans, and legal options provide a structured path to recovery.

Remember: Prevention is always better than recovery. Establishing robust credit policies, using well-drafted contracts, and offering diverse payment options can go a long way in avoiding payment delays.

Still struggling with unpaid invoices? Contact us for tailored solutions to recover your payments effectively! Let us help you secure your cash flow and maintain strong client relationships.