An effective debt collection strategy is the cornerstone of financial stability for businesses. It ensures that payments owed are recovered efficiently, maintaining cash flow and reducing the risk of bad debts. At its core, a robust strategy balances assertive collection efforts with ethical practices, preserving valuable customer relationships while securing overdue payments.

In today’s fast-paced financial landscape, businesses face increasing challenges in debt recovery. Evolving payment trends, rising customer expectations, and diverse communication preferences make traditional methods less effective. Add to this the need for compliance with complex regulations, and the task becomes even more daunting.

This article delves into proven strategies to enhance debt collection efforts. From leveraging technology and automation to implementing customer-centric approaches, we’ll explore actionable insights to help businesses optimize their recovery processes while maintaining positive customer relationships.

The Importance of an Effective Debt Collection Strategy

A well-executed debt collection strategy is more than a financial safeguard; it’s a vital driver of business stability and growth.

Impact on Cash Flow and Business Growth

Timely payments are the lifeline of any business, ensuring steady cash flow to meet operational needs and invest in future growth. An effective strategy minimizes the risk of bad debts, protecting businesses from financial strain and fostering sustainable expansion. By reducing Days Sales Outstanding (DSO) and improving recovery rates, companies can better allocate resources and focus on growth initiatives.

Preserving Customer Relationships

Debt collection doesn’t have to mean sacrificing client relationships. Businesses that approach collections with empathy and transparency can strengthen trust with their customers. Flexible payment options, clear communication, and a willingness to collaborate demonstrate that the relationship goes beyond the transaction, increasing the likelihood of customer retention and long-term loyalty.

Understanding the importance of a well-executed debt collection strategy begins with a clear grasp of the debt collection process. Learn more in our detailed guide, What Is the Debt Collection Process? A Complete Overview. For tailored debt recovery solutions, trust our expert team to help streamline your collections and safeguard your business’s financial stability.”

Key Challenges in Business Debt Collection

Debt collection, while essential for financial stability, presents several obstacles that businesses must overcome to maintain efficiency and compliance.

Managing Large Volumes of Delinquencies

Handling a high volume of overdue accounts can overwhelm collections teams, especially when prioritization is unclear. Without a data-driven approach, businesses may struggle to identify aging accounts or high-risk customers who require immediate attention. This inefficiency often results in wasted resources and missed recovery opportunities.

Compliance with Regulatory Requirements

Debt collection operates within a complex legal framework, requiring businesses to navigate varying federal, state, and local regulations. Ensuring compliance with laws such as the Fair Debt Collection Practices Act (FDCPA) is essential to avoid legal penalties and protect the company’s reputation. However, staying updated on regulatory changes and implementing compliant processes can be challenging for businesses.

Adapting to Technological Advances

As technology evolves, many businesses fall behind in leveraging automation and artificial intelligence to optimize their debt collection processes. Manual workflows and limited integration of collection software with CRM systems hinder efficiency, making it harder to streamline operations, enhance customer communication, and achieve better recovery rates.

Proven Strategies to Improve Debt Collection

Effectively managing debt collection is essential for maintaining cash flow and fostering healthy customer relationships. Here are proven strategies businesses can implement:

1. Thorough Credit Assessment Before Extending Credit

- Evaluate Creditworthiness: Conduct comprehensive credit checks during customer onboarding to assess financial reliability.

- Set Credit Limits and Terms: Establish risk-based credit limits and transparent terms to minimize exposure to bad debts.

2. Implementing Clear Payment Terms and Policies

- Simplify Contracts: Use plain, transparent language to avoid misunderstandings about payment obligations.

- Specify Penalties: Clearly define late fees, penalties, and deadlines to encourage timely payments.

3. Offering Flexible and Customized Payment Plans

- Support Financial Challenges: Provide tailored payment options for customers experiencing temporary hardships.

- Encourage Partial Payments: Increase recovery chances by allowing manageable payment installments.

4. Leveraging Technology and Automation

- Automate Reminders: Use advanced debt recovery software to send timely reminders and manage dunning processes.

- Optimize with Analytics: Utilize predictive analytics to prioritize high-risk accounts and tailor collection strategies.

5. Personalized Communication Approaches

- Tailored Messaging: Craft reminder messages specific to each customer’s situation for a more empathetic approach.

- Adapt to Preferences: Respect customer communication preferences, whether through email, phone, or SMS.

6. Incentivizing Early Payments

- Provide Rewards: Encourage prompt payments with discounts or loyalty incentives for customers.

- Promote Good Behavior: Reinforce positive payment habits to reduce future delinquencies.

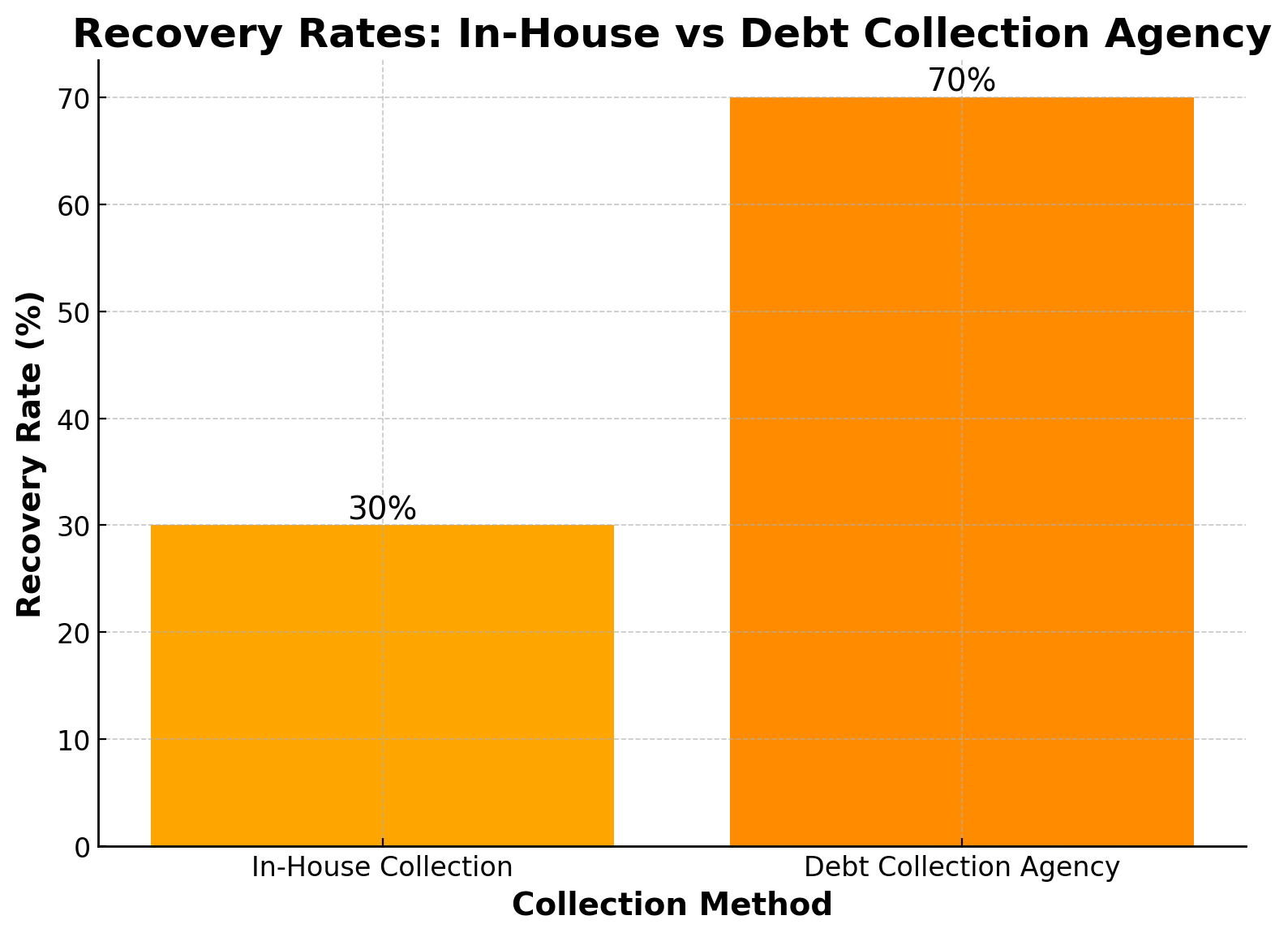

7. Engaging Debt Collection Agencies for Tough Cases

- Outsource Complex Recoveries: Partner with reputable agencies to manage accounts that are difficult to collect.

- Focus Internally: Concentrate internal efforts on strategic accounts while outsourcing time-intensive recoveries.

By implementing these strategies, businesses can enhance their debt collection process, improving recovery rates while maintaining strong customer relationships.

For businesses looking to strengthen their debt collection strategies, gaining insights into recovering unpaid invoices is essential. Explore our comprehensive resource, A Complete Guide on How to Recover Unpaid Invoices from Businesses, for actionable advice and proven methods.

Examples of Debt Collection Strategies in Action

Scenario 1: A Retail Business with Overdue Invoices

Challenge: A mid-sized retail company struggled with overdue invoices from multiple clients, causing significant cash flow disruptions. Despite automated reminders, some customers ignored payment requests, leading to a growing list of delinquent accounts.

Solution:

- Implemented advanced AI-based tools to segment and prioritize high-risk accounts.

- Engaged a legal expert to draft and review payment demand letters, ensuring they complied with local regulations and carried legal weight.

Outcome: Recovery rates improved by 40% within six months. The legal expert’s involvement added credibility to payment demands, encouraging faster responses from debtors.

Scenario 2: A Service Provider Dealing with Repeat Late Payers

Challenge: A professional services firm faced recurring issues with late payments due to unclear contracts and vague payment terms. This led to client disputes and strained relationships.

Solution:

- Retained a legal expert to revise all client contracts, incorporating clear payment terms, late fee structures, and arbitration clauses.

- The legal expert also provided training to staff on how to handle disputes professionally and escalate issues when necessary.

Outcome: Late payments decreased by 50%, as clients better understood their obligations. The firm also resolved disputes more efficiently, preserving key client relationships.

Scenario 3: A Small Business Owner Facing Payment Defaults

Challenge: A small business owner running a boutique furniture store faced payment defaults from several large orders, jeopardizing their operational budget. With limited resources, they were unable to pursue collections effectively.

Solution:

- Hired a legal expert to initiate formal demand letters and guide them through the process of filing small claims for high-value debts.

- The legal expert also advised on when to escalate cases to a collection agency or take legal action.

Outcome: Recovered 75% of outstanding payments within eight months. The presence of a legal expert streamlined the collection process and ensured all actions were compliant with local debt recovery laws.

Conclusion

The success of any business depends significantly on its ability to maintain healthy cash flow and foster customer trust. Enhancing debt collection strategies is vital not only for financial stability but also for strengthening client relationships.Collaborate with experienced legal experts to develop tailored, legally compliant debt recovery strategies. By ensuring adherence to regulations and leveraging professional insights, you can protect your business interests while maintaining positive relationships with your clients. Reach out today to craft a customized legal framework for your debt collection needs.